Neighbourhood batteries are one of a range of new technologies being developed and implemented in response to a rapidly changing energy system. This time of change brings a range of uncertainties, which are part of the context of design and implementing neighbourhood battery models. You need to be aware of these uncertainties as you embark on your neighbourhood battery journey.

Energy & FCAS markets

The projected uptake of electric vehicles over the next ten years will likely see significant cost reductions in chemical battery storage. As a result, the capital costs for the purchase of a neighbourhood battery are expected to decrease over the next few years, although predicting the exact price reduction is difficult.

However, a factor that needs to be considered in projecting future cost reductions for batteries is the cost, both financial and environmental, of continuing to source critical minerals that are essential components of batteries, including lithium and cobalt.

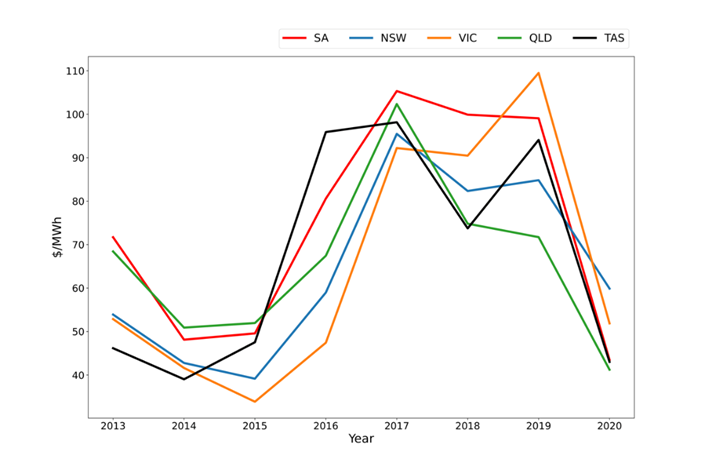

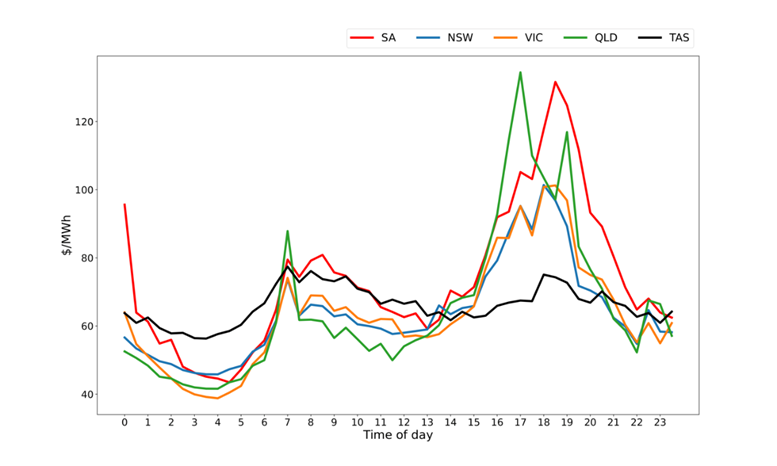

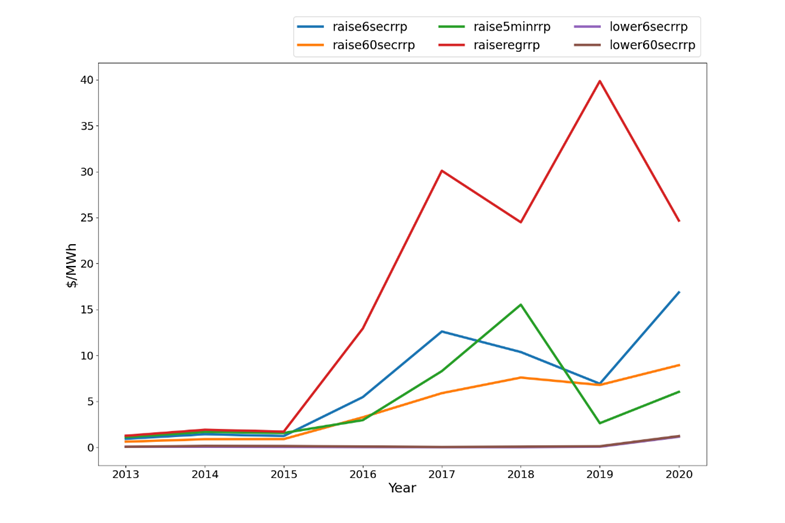

The revenue derived from the energy and FCAS markets in Australia can be quite volatile, fluctuating with changes of supply and demand, network outages, supply charges, network costs, and the generation mix in the grid.

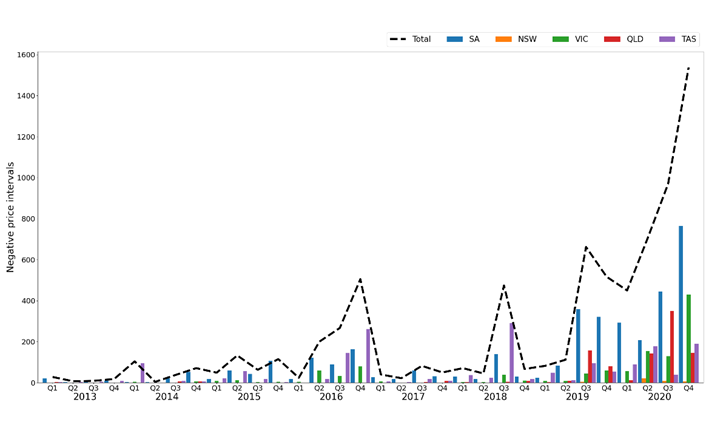

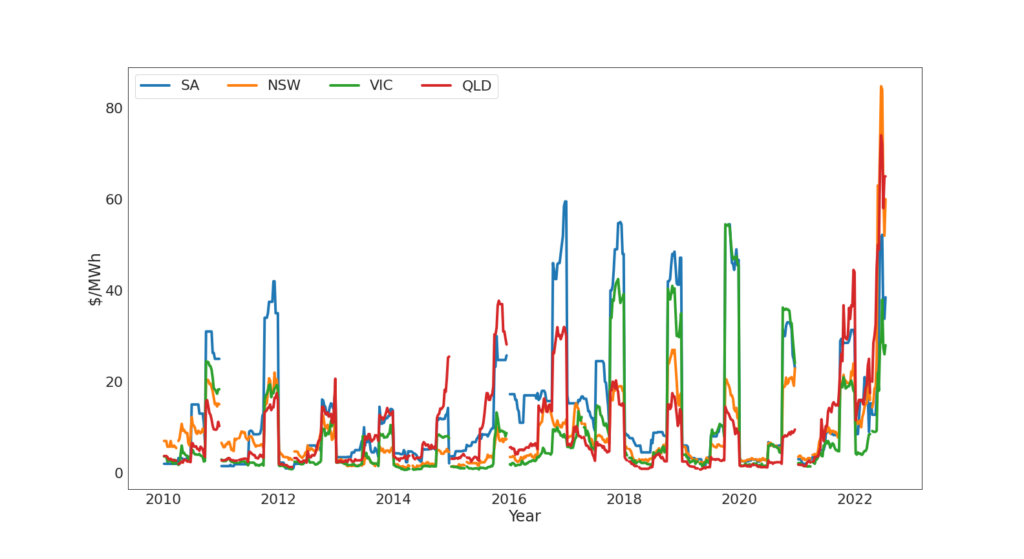

The figures below show how the energy and FCAS market prices have changed across NEM regions over the last 10 years.

The volatility of the Australian energy market has specifically been evident in 2022, where the impact of the war in the Ukraine and global skyrocketed gas prices has heavily driven up the energy spot price here in Australia. Until all generation in the NEM can be met by renewable generators (solar, wind, hydro, pumped hydro, battery storage) there remains a considerable chance for high energy prices to continue occurring because of reliance on gas to meet the last percentage of demand. This may especially worsen as more coal plants are decommissioned at the end of the decade.

Further, the increased penetration of renewables in the energy market has resulted in some interesting changes to the energy market price in recent years. These include the increasing prevalence of negative energy market prices. Negative market prices can occur in the NEM when all bids for that time period are negative (usually associated with times of low demand when power plants, particularly coal-fired ones, still need to continue operating to avoid shut down and start-up costs).

For intermittent renewable generation like wind and solar, specifically at times of abundant wind or solar resources, generators will often place negative bids at the AEMO market floor price (-$1,000/MWh) to ensure they are able to generate during those times. Renewable generators are also incentivised by supplemental revenue streams to generate during times of negative prices, including renewable energy certificates based on every MWh they produce.

Similarly, the revenue that can be derived from energy market contracts using a neighbourhood battery, such as cap contracts, have variable premium prices that differ depending on the month, time of day, location, and season, which can alter the profit attainable. Contracts in the NEM, however, do have the core function of balancing variations in the energy and FCAS spot price. They allow a neighbourhood battery to have a set income from the premium price and the contract’s final settlement value that can make predicting battery revenue easier and more reliable.

The figures below shows how the premium price has varied over the last ten years between the different NEM regions.

Battery operation and lifetime

Depending on the operation of the battery, including its frequency of charging and discharging cycles and its depth of discharge during these cycles, the warranted 15-20 year lifetime of a neighbourhood battery can be shortened due to advanced degradation. Similarly, over the course of the battery’s lifetime, its efficiency and performance may deteriorate at different rates depending on a number of factors, including the battery’s location and climate.

Currently Lithium-ion batteries are the most common and widely deployed battery chemistry, achieving high efficiency and discharge rates. Alternative battery chemistries, such as graphene or vanadium flow batteries, however, are seeing significant advances. In the future, alternative battery chemistries may influence the cost of batteries (including in their reliance on rare minerals) but may also change some of their properties and operation.

Different scales of storage

There is general agreement that different scales of storage are needed and complementary, but there is still some competition between different types of storage in relation to demand and role in the energy system. Neighbourhood batteries appear to be a more efficient way of deploying storage capacity per household, but there are various reasons why people may choose to install household batteries, which may be enhanced by government schemes. Electric vehicles are also likely to take on roles in energy storage. Both of these will compete with neighbourhood batteries in the storage of residential solar.

Similarly, grid-scale batteries and pumped hydro will provide storage in the grid which has different features to neighbourhood batteries (e.g. size, distribution, inertia services, response time), but may compete with neighbourhood-scale storage. The balance of storage will be influenced by government policy, but also by the decisions of energy businesses, investors and communities.

Energy system transition

In a rapidly transitioning energy system, the future grid, and the technologies supporting it, is not a given. There are different ways to transition to a low carbon energy system. Neighbourhood batteries are likely to play a key role, but what this will look like and how it will change are unknowns.

In their 2022 Integrated Systems Plan, AEMO predicted a five times increase in distributed energy resources. They expect that by 2050 over 65% of detached homes will have rooftop solar, most coupled with a battery, to meet their household energy needs and export surplus back into the grid. As this distributed generation grows, the operational demand on the NEM will continue to evolve. For example, maximum demand is now occurring closer to sunset in most regions. Due to these changes, critical system services will have to evolve in the coming decades, supported by regulatory changes.

Generally, growth in renewable energy technologies in the energy system will influence many aspects of a neighbourhood battery’s operation. Environmentally, renewables penetration will alter the emissions intensity of the grid across the day, changing the emissions reduction value the battery offers. This is not to say however that neighbourhood-scale batteries will not have important ongoing roles to play in supporting renewables, particularly in the context of demand management.

With more neighbourhood batteries and renewables in the energy system, we will also see roles in the energy system changing, including of retailers and DNSPs. The ability of neighbourhoods to meet their demand locally from generated rooftop solar and storage may reduce the extent to which retailers can maintain control over electricity prices. DNSPs will remain important in maintaining the distribution network, but will have to accommodate the increasing prevalence of bidirectional electricity flows and variable generation throughout the day.

Further, the role of balancing distributed energy generation may rather be achieved in some or all parts of the energy system by upgrades to network infrastructure, including transmission lines, through load shifting or by use of digital demand management systems, such as dynamic operating envelopes, rather than neighbourhood batteries.

Regulatory change

Changes in regulations will have a variety of effects on the operation, compliance and revenue of a neighbourhood battery.

It was recently flagged that federal and state governments had agreed to modify the National Energy Objectives (NEO) to include an emissions objective for the first time. Such a change will have various influences on the energy system, including changing requirements for DNSPs. It is likely to have a positive effect on the feasibility of neighbourhood battery implementation.

Currently, there is no emissions reduction scheme that can be applied to neighbourhood batteries to provide an additional revenue stream. This is because the main carbon pricing scheme in Australia, the Australian Carbon Credit Unit (ACCU) scheme that is administered by the Clean Energy Regulator (CER) under the Emissions Reduction Fund (ERF), as of 2022 cannot be applied to neighbourhood batteries.

For context, an ACCU represents one tonne of carbon dioxide equivalent (tCO2e) that has been stored or avoided by a project. ACCUs are a financial unit that can help reduce the total capital costs of a project if it enables emissions reductions. They are typically sold to large corporations needing to offset their carbon footprint, or by the Federal Government in a bid to support decarbonisation projects. ACCUs are tracked on the Australian national registry of emissions units (ANREU), which individuals or organisations must use if they want to own, transfer, cancel or relinquish ACCUs.

The price of ACCUs has risen considerably from 2019, reaching $37 in November 2021 and then over $55 in early 2022. Compared to the global market for carbon credits, however, this ACCU price is relatively low, with the price of carbon permits in Europe up to 2022 exceeding $100. Further, the price of ACCUs can be quite variable and subject to market change or government intervention.

As more ambitious emissions reductions targets are put in place, the voluntary ACCU scheme may be replaced by a mandatory system of carbon pricing. As mentioned in the Funding section, there are other national and international carbon offset schemes which may also become more relevant. Changes in carbon pricing are likely to influence the economic cost-benefit associated with neighbourhood battery projects in positive ways and increase the roles and revenues available to neighbourhood battery projects. Note that they require quantitative analysis of the emissions reductions that a project can achieve. See Environmental Goals & Impacts.

Changes in regulation may also include tariff changes (influencing costs & revenues), DNSP reporting requirements (influencing data availability) and rules concerning ownership (e.g. ringfencing).

How uncertainties can impact testing

Bringing uncertainties into your testing can be an important way to explore:

- What are the margins associated with your model? Will it withstand changes in key parameters or failures in assumptions, particularly ones you have no control over?

For example, your model might rely on a subscription model and a certain number of people signing up. If you don’t get this number, your project might fall over, so it might be worth over-estimating participation. If energy markets change, revenue streams may fail to cover costs. You may need to build a buffer for this into your model. - What changes might make your model more feasible? Can you work with these to make your model more robust?

For example, a longer lifetime may make your battery project more feasible. This may make it worth investing a bit more in a battery with a better life expectancy, or perhaps there are changes to the operation of the battery that could extend its life. Both of these responses would have to be factored back into your modelling. - Are there measures you can take to protect against future changes? Can you anticipate some likely changes and build them into your model?

For example, perhaps you can negotiate for tariffs to be fixed for several years as part of your agreement with your DNSP. Or you could anticipate an increase in electric vehicle uptake by exploring fast charging of EVs from your battery.