Energy arbitrage

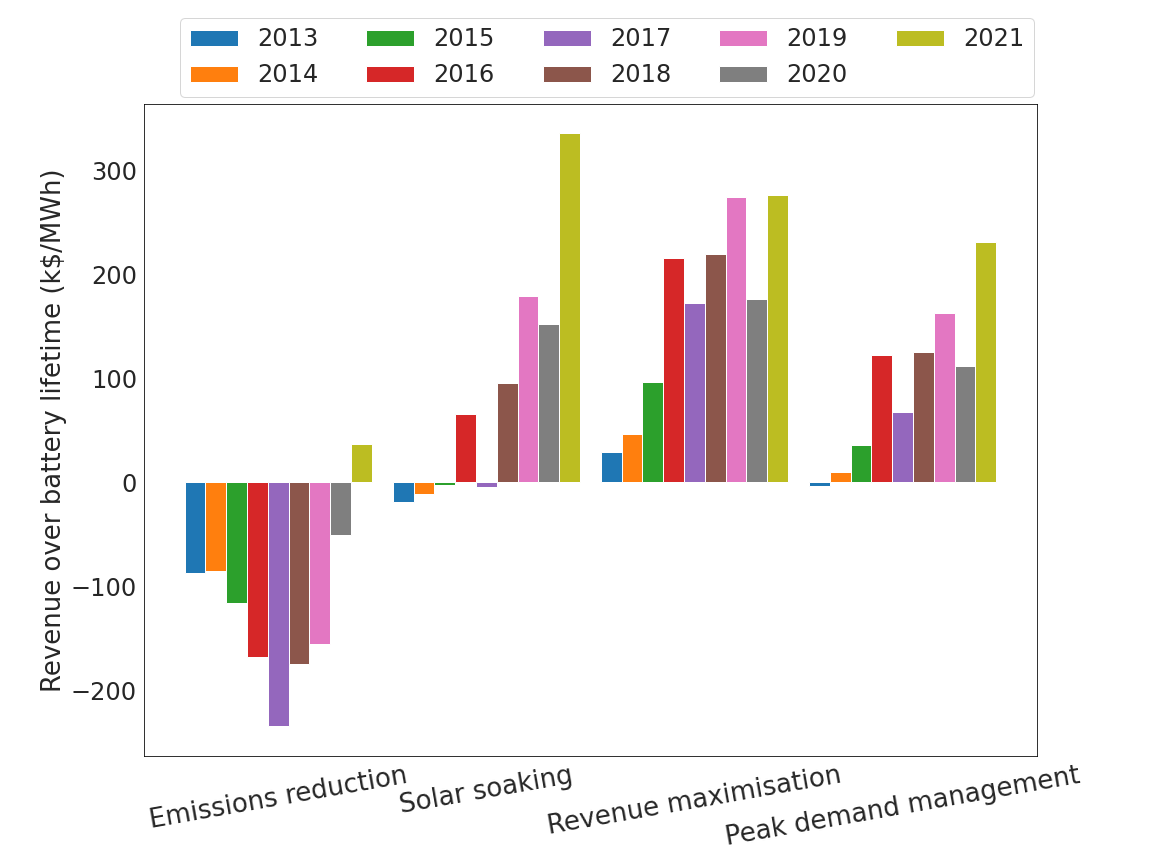

There are four main scenarios for how a battery may operate (charging/discharging) for buying and selling energy in the energy market (arbitrage). We have modelled these four scenarios to give you an idea of the implications for revenue. These are:

| Scenario | Charging Times | Discharging Times |

|---|---|---|

| Emissions reduction | 12-2pm | 2-4am |

| Solar soaking | 12-2pm | 5-7pm |

| Revenue maximisation | 2-4am | 5-7pm |

| Peak demand management | 2-4am, 12-2pm | 7-9am, 5-7pm |

Note that in all scenarios, a battery’s potential energy arbitrage revenue will also be influenced by the depth of discharge (DoD) (taken here as 90%), the roundtrip efficiency, (taken here as 85% and applied to the battery’s discharge potential) and the battery state of health taken to be 80% after 10 years.

In peak demand management, as it involves the battery going through two full charging/discharging cycles per day, the battery’s lifetime will be reduced by half to only five years. In all scenarios, the battery was assumed to have a charging and discharging capacity of two hours. The following figures have been provided to give an estimate of the potential scale of revenue that can be obtained from energy arbitrage, and also how revenue has varied per year across the last decade.

The figure above provides an upper limit estimate of energy arbitrage revenue in Victoria for the four different energy arbitrage operating schedules. Note the schedule focused on reducing emissions generally results in negative revenue. This however changed in 2021 due to the lower spot prices seen midday thanks to high penetrations of solar and wind. Note also that revenues are generally increasing over time.

It is important therefore to have clear values and purpose when designing the operation of your neighbourhood battery as the most environmentally beneficial operating schedule will not satisfy specific cost reduction goals, for example. Given the increasingly cheap cost of midday energy due to the increased amount of solar and wind driving down the price, you can also see how operation for solar soaking actually overtook that for cost reduction from 2020.

FCAS

FCAS is a potential source of revenue for neighbourhood batteries. FCAS is divided between regulation and contingency FCAS. Regulation FCAS is the correction of generation/demand balance in response to minor deviations in load or generation, whilst contingency FCAS is in response to a major contingency event like the loss of a generating unit or large industrial load. Regulation FCAS is controlled centrally from AEMO’s control centres, while contingency FCAS is controlled locally and triggered by a major contingency event. FCAS is split between two regulation markets (Regulation Raise and Regulation Lower) and six contingency (Fast Raise, Fast Lower, Slow Raise, Slow Lower, Delayed Raise, and Delayed Lower) markets with response times varying from 6 seconds to 60 seconds to 5 minutes. As batteries represent both generation and load, they can provide services in all six contingency markets by instantaneously varying their charging or discharging power in response to frequency variation triggers.

Currently, only contingency FCAS is available to neighbourhood batteries, however going forward and with the maturity of batteries in the NEM it is likely neighbourhood batteries will soon be able to also provide regulation FCAS.

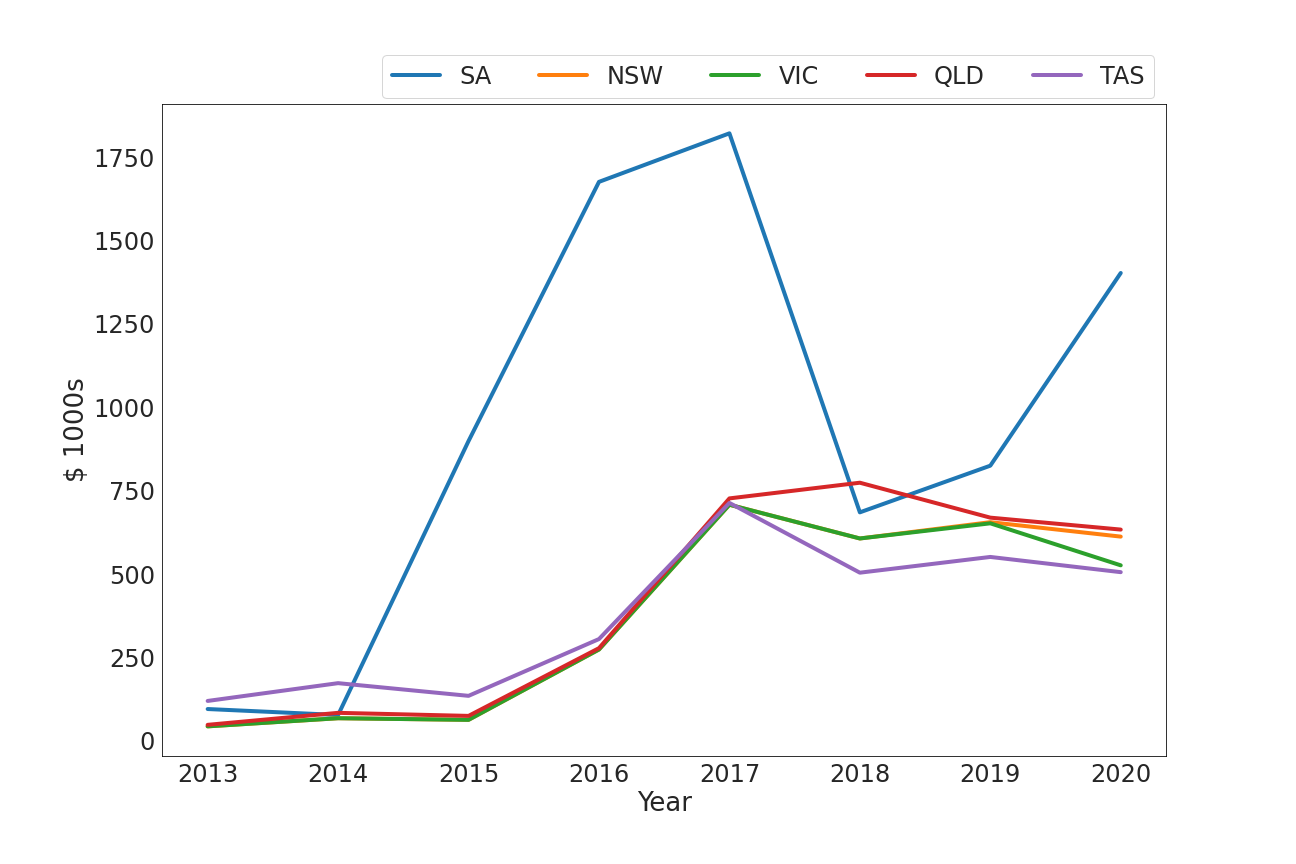

The following figure estimates the FCAS revenue (per 1MW) that could potentially have been obtained over the last 8 years across the different NEM regions assuming services provided in all eight FCAS markets. It is important to note that this revenue is highly variable and has been predicted to decrease in coming years. This is because, as more and more batteries are installed throughout Australia, and these batteries all begin to offer FCAS, the market value for FCAS will decline.

Imperfect foresight, taken to be 50% less than that of perfect foresight, is therefore calculated as a more realistic FCAS revenue, accounting for factors like variability in FCAS prices, battery response/s, and participation in only six of the eight FCAS markets. FCAS bids currently must be greater than 1MW, meaning neighbourhood batteries will typically have to participate in aggregated FCAS bids with other market participants via an aggregator.

Despite its predicted decline, whilst still in the early days of battery energy storage installation, FCAS can offer an important additional revenue stream to support the uptake of new battery projects. As explained in Tariffs, markets and network services, to participate in FCAS bids have to be at least 1MW, meaning you will have to partner with an aggregator if your neighbourhood battery is less than 1MW capacity.

Cap contracts

Cap contracts are purely financial and not dependent upon physical delivery of generation, with the generator paying out to the retailer based off the spot price outcomes and volume sold. Cap contracts are mutually beneficial to both the retailer and generator, but in different ways. Cap contracts provide security for small retailers against high spot prices during periods of high demand that could otherwise drive them out of business. Under the contract, the spot price paid by retailers is capped at $300/MWh. To compensate for this insurance, retailers pay generators a premium in $/MWh for a fixed volume (in MW). Premium price can range from as low as around $5/MWh for a quarter long contract, up to almost $60/MWh for a quarter long contract.

Revenue from cap contracts will be reliant on the capacity and ability of the battery to respond to all price spikes in the energy market. If price spikes occur and the battery is not charged and able to generate, it will incur a financial penalty. It also may encourage the battery to charge/discharge outside of its normal operation, which could undermine, for example, a battery operated to only charge off excess solar. In an energy market with increasingly common high spot prices above the cap, there also may be increased possibility for cap contracts to result in less revenue for the battery owner than would have been obtained playing the spot market with energy arbitrage.

It is therefore recommended that cap contracts are only considered later down the path in your project and for projects of larger scale (i.e. larger neighbourhood battery capacities or for a network of neighbourhood batteries) to insure against financial penalties associated with not charging/discharging at the correct time and to allow greater contract sizes.